Introduction to Coinbase and its services

Are you looking for a convenient and secure way to manage your cryptocurrency assets? Look no further than Coinbase! With its array of services tailored for crypto enthusiasts, Coinbase has now introduced an innovative solution – the Coinbase card. Let’s dive into how this card works, its benefits, and how you can make the most out of it for your everyday transactions.

What is a Coinbase card and how does it work?

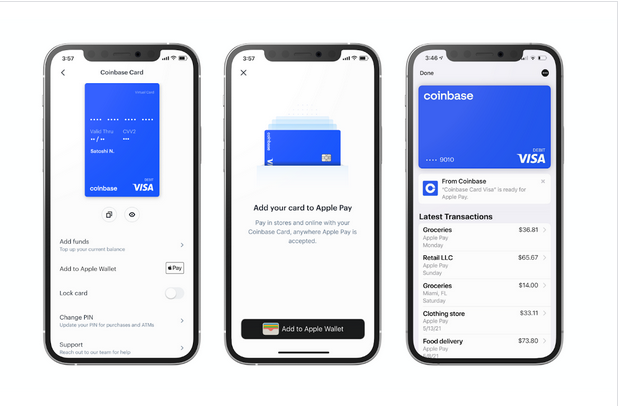

Curious about how a Coinbase card can enhance your crypto experience? Let’s dive in. A Coinbase card is a debit card linked to your Coinbase account, allowing you to spend your cryptocurrency like traditional money at any merchant that accepts Visa. It works by converting your selected cryptocurrency into fiat currency at the point of sale, making transactions seamless and convenient.

The process is straightforward – simply load your desired amount of cryptocurrency onto the card through the Coinbase app, and you’re ready to start using it for purchases or withdrawals. The conversion happens instantly, giving you real-time access to your digital assets in physical form.

With a Coinbase card, you have the flexibility to manage both crypto and fiat currencies easily in one place. Plus, it offers the convenience of spending crypto anywhere Visa is accepted without needing to liquidate your holdings beforehand.

Benefits of using a Coinbase card

Using a Coinbase card comes with a range of benefits that can enhance your financial transactions and provide added convenience. One key advantage is the ability to seamlessly convert your cryptocurrencies into fiat currency, allowing you to spend your digital assets in everyday situations. This flexibility opens up new opportunities for using your crypto holdings for purchases at millions of locations worldwide where Visa cards are accepted.

With a Coinbase card, you can also earn rewards on every purchase made using the card. These rewards come in the form of cryptocurrency cashback, providing an additional incentive to use the card for your spending needs. By leveraging these rewards, you can maximize the value of your transactions and potentially increase your crypto holdings over time.

Moreover, using a Coinbase card offers enhanced security features such as real-time transaction notifications and the ability to instantly lock or unlock your card through the app. This added layer of protection helps safeguard against unauthorized use and provides peace of mind when making purchases both online and offline.

Steps to get a Coinbase card

Are you ready to get your hands on a Coinbase card and unlock a world of possibilities in the realm of cryptocurrency transactions? Let’s walk through the simple steps to acquire your very own Coinbase card.

Ensure that you have a verified Coinbase account. This is essential as the card is directly linked to your Coinbase wallet, allowing for seamless transactions.

Next, navigate to the “Card” section within your Coinbase account dashboard. Here, you will find all the information regarding the Coinbase card and how to apply for one.

Fill out the necessary details required for card issuance, including personal information and shipping address. Double-check everything before submitting your application.

Once approved, you’ll receive your physical Coinbase card via mail. Activate it through the provided instructions and link it to your existing Coinbase wallet.

Voila! You’re now ready to use your Coinbase card for purchases online or in-store wherever Visa cards are accepted. Enjoy convenient access to spend crypto like never before with ease and security at your fingertips.

How to use a Coinbase card for purchases and withdrawals

To use a Coinbase card for purchases and withdrawals, you first need to ensure that your card is linked to your Coinbase account. Once that’s set up, using the card is pretty straightforward.

When making a purchase in-store or online, simply swipe or enter the card details just like you would with any other debit card. The transaction will be deducted from your Coinbase account balance instantly.

For withdrawing cash from an ATM, locate a supported machine and insert your Coinbase card. Follow the on-screen instructions to enter your PIN and select the amount you wish to withdraw. Remember that there may be fees associated with ATM withdrawals, so it’s essential to check this beforehand.

Keep track of your transactions by regularly reviewing your Coinbase account activity. This will help you stay on top of your spending and monitor any unauthorized charges effectively. Using a Coinbase card offers convenience and flexibility when managing your digital assets for everyday expenses.

Security measures and precautions

When it comes to using your Coinbase card, security is a top priority. To ensure the safety of your funds and personal information, Coinbase has implemented various security measures and precautions.

One key feature is the ability to instantly freeze your card through the app if it’s lost or stolen. This prevents any unauthorized transactions from taking place. Additionally, you can set up transaction notifications to stay informed about any activity on your card in real-time.

Coinbase also utilizes advanced encryption technology to protect sensitive data during transactions. This helps safeguard your financial details from potential cyber threats and hackers. Moreover, two-factor authentication adds an extra layer of security by requiring a code in addition to your password for account access.

To further enhance security, avoid sharing your card details or login credentials with anyone else. Be cautious when using public Wi-Fi networks for transactions and regularly monitor your account for any suspicious activity.

By following these security measures and precautions, you can use your Coinbase card confidently knowing that your finances are well-protected against potential risks.

Conclusion

Is a Coinbase card right for you? The decision to get a Coinbase card depends on your individual needs and preferences. If you are an active cryptocurrency user looking for convenience and flexibility in spending your digital assets, then a Coinbase card could be a valuable addition to your financial toolkit. With its ease of use, wide acceptance, and security features, the Coinbase card offers a seamless way to bridge the gap between crypto and traditional finance. Consider evaluating your spending habits, financial goals, and comfort level with managing cryptocurrencies before deciding if the Coinbase card aligns with your lifestyle. It may just be the perfect solution to streamline your everyday transactions while enjoying the benefits of both worlds – crypto and fiat currencies.