Introduction to Cryptocurrency

Welcome to the exciting world of cryptocurrency, where digital assets revolutionize the way we think about money and investments. In this fast-paced market, keeping track of cryptocurrency prices by market cap is essential for any savvy investor looking to stay ahead of the game. Let’s dive into understanding what market cap means and explore the top cryptocurrencies making waves in the industry today.

What is Market Cap?

Cryptocurrency prices are often determined by a metric known as Market Cap, short for Market Capitalization. It is calculated by multiplying the total circulating supply of a cryptocurrency by its current market price. In simpler terms, it reflects the total value of a particular cryptocurrency in the market.

Market cap helps investors gauge the size and importance of a crypto asset within the vast digital currency landscape. The higher the market cap, generally speaking, the more established and widely recognized the cryptocurrency is.

It’s essential to understand that while market cap provides valuable insights into a cryptocurrency’s standing among peers, it doesn’t necessarily indicate its future potential or performance. Factors like adoption rates, technological advancements, regulatory developments, and overall market sentiment also play crucial roles in influencing cryptocurrency prices.

Therefore…

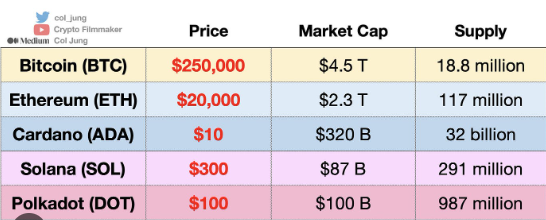

Top 5 Cryptocurrencies by Market Cap

Cryptocurrencies have taken the financial world by storm, with their market cap playing a crucial role in determining their value and popularity. The top 5 cryptocurrencies by market cap are constantly changing as the market fluctuates.

Bitcoin, often referred to as digital gold, consistently holds the top spot in terms of market capitalization. Ethereum follows closely behind with its smart contract capabilities and decentralized applications.

Ripple, known for its focus on facilitating cross-border transactions, secures a position in the top 5 cryptocurrencies by market cap. Binance Coin and Cardano also make the list due to their strong communities and innovative technology.

Investors closely watch these leading cryptocurrencies’ market caps as they provide valuable insights into trends and potential investment opportunities within the ever-evolving crypto space.

Factors Affecting Cryptocurrency Prices

Cryptocurrency prices are influenced by various factors that can impact their value in the market. One key factor is market demand and supply dynamics. When there is high demand for a particular cryptocurrency and limited supply available, its price tends to increase. Conversely, if the supply outweighs the demand, the price may drop.

Another significant factor affecting cryptocurrency prices is regulatory developments. Government regulations or bans on cryptocurrencies can cause uncertainty among investors, leading to fluctuations in prices. Positive news such as legalizing or regulating cryptocurrencies can have a bullish effect on prices.

Technological advancements and updates also play a role in determining cryptocurrency prices. Improvements in security protocols, scalability solutions, or new features can enhance the utility and attractiveness of a specific digital asset, potentially driving its price up.

Moreover, market sentiment and investor psychology heavily influence cryptocurrency prices. Fear, uncertainty, and doubt (FUD) circulating in the media or social platforms can lead to panic selling and price declines. On the other hand, positive news or endorsements from influential figures can create hype and drive prices higher.

It’s essential for investors to stay informed about these factors impacting cryptocurrency prices as they navigate this volatile market environment.

Tips for Investing in Cryptocurrencies

Interested in diving into the world of cryptocurrency investing? Here are some valuable tips to consider before making your first move.

Research and educate yourself on different cryptocurrencies. Understand what sets each one apart and their potential for growth.

Diversification is key – don’t put all your eggs in one basket. Spread your investments across multiple digital assets to mitigate risk.

Stay updated with market trends and news. The crypto market is highly volatile, so being informed can help you make more strategic decisions.

Consider the long-term potential of a cryptocurrency rather than just short-term gains. Think about its technology, use case, and community support.

Set clear investment goals and stick to them. Whether you’re looking for quick profits or long-term holdings, having a plan will keep you focused amidst market fluctuations.

Risks and Benefits of Crypto Trading

Crypto trading comes with its fair share of risks and benefits. On one hand, the decentralized nature of cryptocurrencies can provide a sense of financial freedom as users have control over their funds without reliance on banks or governments. However, this same lack of regulation can also make crypto markets highly volatile and susceptible to manipulation.

The potential for high returns in a short period is undoubtedly enticing for many traders, but it’s essential to remember that these gains come with significant risk. The value of cryptocurrencies can fluctuate dramatically based on market sentiment, news events, or regulatory changes.

Additionally, the anonymity offered by some cryptocurrencies may attract nefarious activities like money laundering or illegal transactions. It’s crucial for investors to conduct thorough research and understand the risks involved before diving into the world of crypto trading.

Current State of the Crypto Market

The current state of the crypto market is dynamic and ever-changing. With Bitcoin leading the way, other altcoins are also making their mark in the industry. The volatility of cryptocurrency prices has both traders and investors on their toes, trying to predict the next big move.

Regulatory developments around the world continue to impact the crypto market, with some countries embracing digital currencies while others remain skeptical. Institutional interest in cryptocurrencies is growing steadily, bringing more legitimacy to this emerging asset class.

Technological advancements like blockchain technology play a significant role in shaping the future of cryptocurrencies. Projects focusing on scalability, security, and decentralization are gaining traction among enthusiasts.

The crypto market remains an exciting space for innovation and investment opportunities. Staying informed and keeping a close eye on market trends are crucial for navigating this fast-paced environment effectively.

Conclusion

As the cryptocurrency market continues to evolve, understanding market cap is crucial for investors looking to navigate this dynamic landscape. By keeping tabs on the top cryptocurrencies by market cap, monitoring factors affecting prices, and being aware of the risks and benefits involved in crypto trading, you can make informed decisions when entering this exciting space.

Remember to always conduct thorough research before investing, diversify your portfolio to mitigate risks, and stay updated on market trends. While the crypto market can be volatile, it also presents unique opportunities for growth and innovation. With careful consideration and a strategic approach, you can potentially benefit from the ever-changing world of cryptocurrencies.

Stay informed, stay vigilant, and may your journey into the world of cryptocurrency be both rewarding and enlightening. Happy investing!